About Property Taxes

Property taxes in Utah are collected by local governments—including counties, cities, school districts, and service districts—to fund essential services and infrastructure.

Why Property is Taxed

Under Utah State law, local governments have the authority to levy a property tax on any property within their geographical boundaries. This tax is not contingent on whether the property owner directly benefits from the services provided by the local government. These taxes fund essential services such as law enforcement, emergency services, road and utility maintenance, schools, and water/sewer infrastructure. Every property within the county falls under the jurisdiction of several local governments. Based on the overlap of these local governments, the county creates Taxing Districts that combine the tax rates of each local government into a single tax rate.

What Determines Your Property Tax?

There are three elements in determining the amount of property tax assessed. The annual budget of a local government, a property's taxable value, and final adopted Tax Rate.

-

Budget: Every local government must adopt a balanced budget each year. The portion of the budget funded by property taxes will be proportionally divided among all taxpayers within the government's boundaries, based on the taxable value of their property.

-

Taxable Value: The portion of a property's value that is taxed is referred to as its Taxable Value. For all property, except primary residences, Taxable Value is 100% of the Assessed Market Value. For primary residences, Taxable Value is only 55% of the Assessed Market Value.

-

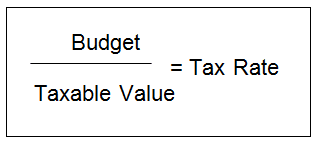

Tax Rate: The tax rate charged to a property owner by a local government is determined by a simple formula: Total Estimated Property Tax Revenue divided by the Total Taxable Value within the government's boundaries. This rate is then applied to each property individually to calculate the property tax due. See below for more detailed explanation.

Where Do My Tax Dollars Go?

Your property taxes help fund essential services that keep our community running smoothly. The accompanying chart shows how these dollars are divided, giving you a clear picture of where your money goes and how it supports the programs and services we rely on every day.

In 2024, Utah County Residents paid a total of $884,213,605 in Property Taxes to local government agencies, as per the 2025 Treasurer 750 Report that can be found at TaxRates.Utah.gov.

Those taxes were distributed to the various local governments in the following amounts:

2024 County Distribution Totals

School Districts - 68.14%

Cities - 12.38%

Utah County - 7.13%

Redevelopment Agencies - 5.17%

Central Utah Water District - 4.15%

Service Districts - 1.53%

Local & State Assessing/Collecting - 1.36%

City Water Districts - 0.15%

Learn more about the specific tax entities that relate to this distribution pie chart.

Tax Entity Information ->How are Property Tax Rates Calculated?

Changes in assessed value can have varied impacts on property owners, especially as values fluctuate across the county. While it may seem logical to expect property taxes to rise and fall in direct correlation with property values, this is not always the case.

There is a relationship between assessed value and taxes due, but general perception and actual practice can differ. Broad changes in assessed value create tax shifts that affect different properties in diverse ways. For instance, if there is an average 10% value increase across the county, a property with only a 5% value increase could see a decrease in taxes. Conversely, if overall county values decrease by 10%, and a property only decreases by 5%, the tax on that property could increase.

Each year assessed values of various geographic regions and property types throughout the county change by different percentages. This results in tax shifts from some areas and property types to others. As illustrated in the examples above, there will inevitably be property owners who, despite receiving a reduction in assessed value, experience an increase in property tax. These examples are illustrative and may not apply to every individual property. The equation to calculate the tax rate is:

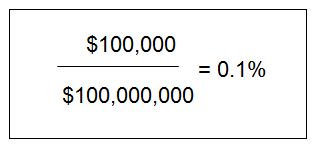

For example, if a local government has a budget of $100,000 and a taxable value within its boundaries of $100 million, then the tax rate for that entity would be 0.1%:

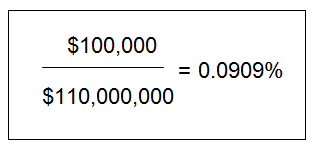

This rate changes every year. If the budget remains the same but the assessed value changes, the rate will change opposite to the assessed value. Using the same example budget again, if the taxable value for this tax entity increased to $110 million, the rate would decrease to .0909%.

To learn more about tax rates and view information specific to each local government in Utah County, visit taxrates.utah.gov and log in as a guest.